Ira return rate

What Is an Average Roth IRA Return Rate. 5 IRA contribution limits are based on earned income.

What Drives Returns In A 60 40 Portfolio Novel Investor Bond Charts And Graphs Portfolio

Account Type APY as high as Term Minimum Opening Deposit.

. 1 Many retirees find themselves in a lower tax bracket than they were in pre-retirement so the tax-deferral means the money may be taxed at a lower rate. A Roth IRA is an individual. Maximum savings at a fixed rate when you lock in funds for the term length.

Be sure to consult a tax professional. APY is annual percentage yield. What Are the Best Dividend Stocks for Your Roth IRA.

Fidelity IRA Return of Excess Contribution Request 1738841112 Page 1 of 4 006940301 1 CUSTOMER InfORMaTIOn Name. Ing federal income tax will be withheld at the rate of 10 from your total IRA distribution amount for Method 2 in Section 3 unless you indicate a higher percentage below. Can You Buy Cryptocurrency in Your Roth IRA.

All rates shown are as low as. Also offers services including brokerage retirement investing advice and college savings. Roth IRA Withdrawal Rules.

Moreover it is important to note that taking your. Best Types of Roth IRA Investments. A fixed rate IRA CD offers tax-free or tax-deferred interest.

Share Certificates IRA Certificates. The net internal rate of return Net IRR is a measure of a portfolio or funds performance that is equal to the internal rate of return IRR after. For Method 1 in Section 3.

These Types of ETFs Are Best for Roth IRAs. 3 - 5 Months. IRA STATE INCOME TAX WITHHOLDING ELECTION The term IRA will be used below to mean Traditional IRA Roth IRA and SIMPLE IRA unless otherwise specified.

Your Age 5-Year Rule Met Taxes and Penalties on Withdrawals Qualified Exceptions. Publication 590 can be accessed by calling the IRS at 1-800-829-3676 or online at wwwirsgov. Compare the best fixed rate IRA CD rates from within 20 miles from your zip code.

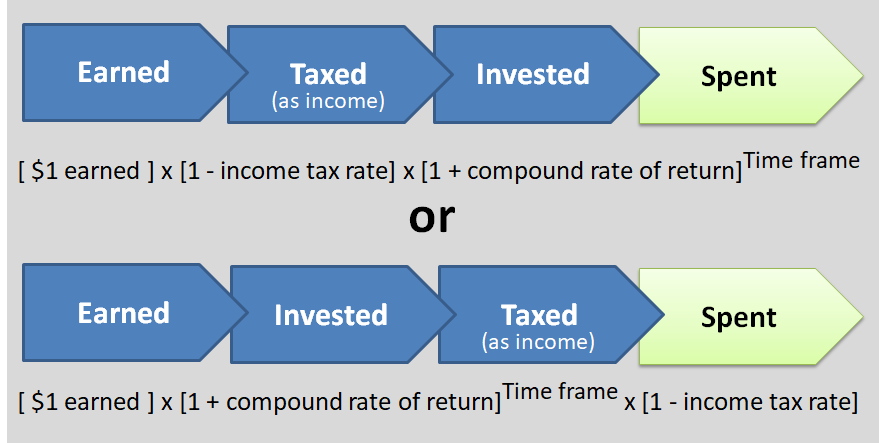

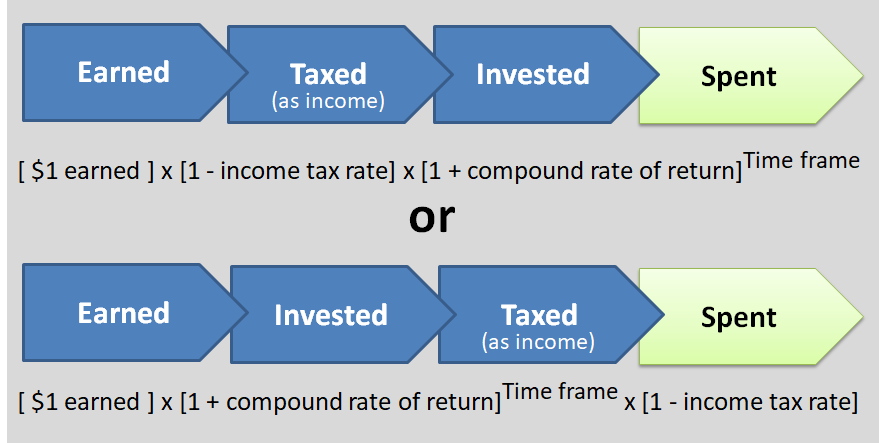

APR is annual percentage rate. You may contribute up to 100 of earned income or the IRA Annual Contribution Limit whichever is less. If the Roth IRA owner expects that the tax rate applicable to withdrawals from a traditional IRA in retirement will be higher than the tax rate applicable to the funds earned to make the Roth IRA contributions before retirement then there may be a tax advantage to making contributions to a Roth IRA over a.

The employers deadline for filing its annual tax return including any extensions. Prudent management of your IRA is vital for long-term financial security in retirement. Use this section to elect a withholding rate not listed on page 1.

Early withdrawal penalties apply. An excess IRA contribution occurs if you. Sarah may contribute 7000 to her IRA for 2020 6000 plus an additional 1000 contribution for age 50 and over.

The Net Internal Rate Of Return - Net IRR. Her spouse may also contribute 6000 to an IRA for 2020. The best-known IRAs are the Roth and traditional.

TRADITIONAL IRA RMD PAYMENT ELECTION FORM 2318 2020 Ascensus LLC FEDERAL WITHHOLDING ELECTION Form W-4POMB No. One of the most-capitalized fund companies specialized in mutual and exchange-traded index funds. All consumer loan rates are determined by an assessment of your credit and may vary from rate shown.

Tax on excess IRA contributions. These rules will give. 1545-0074 Complete an IRA State Income Tax Withholding Election Form 2312 if applicable.

Here are the basics on contributions tax. She and her spouse age 48 reported taxable compensation of 60000 on their 2020 joint return. Traditional IRA - You make contributions with money you may be able to deduct on your tax return and any earnings can potentially grow tax-deferred until you withdraw them in retirement.

View a side-by-side comparison of Ally Banks IRA plans and rates for IRA CDs Savings Account to choose the right option. Your withholding election will remain in effect for any subsequent withdrawal unless you change or revoke it. Contact phone number.

4 Consult your tax advisor or IRS Publication 590 to determine what type of IRA is right for you. How To Invest in Gold With a Roth IRA. I file a tax return in Name of state Check and complete one box below Withhold Withhold Do not withhold.

You agree to let the financial institution use your money for a set period of time in return for a fixed rate. But other types include the Spousal IRA SEP IRA SIMPLE IRA nondeductible IRA and self-directed IRA.

Pin On Real Estate Facts Quotes

Illustrating The Value Of Retirement Accounts Retirement Accounts Accounting Investing

Here Is What You Could Expect In Retirement If You Use A 401k Tsp 403b 457 Or Ira As Your Retirement Investment Investing For Retirement Investing Stock Market

5 Investment Tax Mistakes To Avoid

What Should I Put In My Roth Ira What You Put In A Roth Ira Will Have A Real Impact On Wealth Accumulation Stocks In A Roth Will Give Roth Ira

Internal Rate Of Return Irr Formula Real Estate Investor Real Estate Investing Metric

Roth Vs Traditional Ira Decision Which Ira Will Maximize Your Money Traditional Ira Roth Vs Traditional Ira Ira

Real Estate Shines As An Investment In 2015 Investing Real Estate Tips Real Estate

Compounding Growth Visualization Roth Ira Investing Early Retirement

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

How To Confidently Buy An Investment Property My Go No Go System Buying Investment Property Investment Property Investing

Understanding Your 401 K Statement Finances Money Finance Saving Finance Investing

Bd A Are You Able To Save More Money Mag Battle Low Returns By Saving More Finances Money Smart Money Saving

How To Build A Nest Egg Investing Investing Infographic Start Investing

How I Built A Tax Free Portfolio With 15 Annualized Returns Retirement Portfolio Dividend Stocks Investing

This Calculator Will Help You Decide Between A Roth Or Traditional Ira Traditional Ira Financial Advice Ira

Revisiting And Revising The Investor Policy Statement Physician On Fire Investing Investors How To Plan